The Price of BINANCE Coin jumps by 12% while the exchange records a net inflow of $1.2 billion. What comes next?

BINANCE recorded a net inflow of $1.2 billion amid market correction, boosting the coin price above $400. With a rebound to $481, BNB eyes a 25% rise to $610.

When the market for digital currencies recovered from a recent sell-off, the price of Binance coin increased by 12% yesterday. With Bitcoin, the most valuable digital asset, demonstrating its resilience above $5,000, most major cryptocurrencies have seen a relief rally. Buyers must, however, ride this upswing or resurgent selling pressure may force a protracted decline.

Binance Exchange: Record Inflow of Witnesses

In the midst of the most recent market downturn, Binance reported a noteworthy $1.2 billion net inflow in the last day. The CEO of this cryptocurrency exchange, Richard Teng, notes that this development is one of the strongest days for net inflows in 2024, indicating a high level of investor confidence.

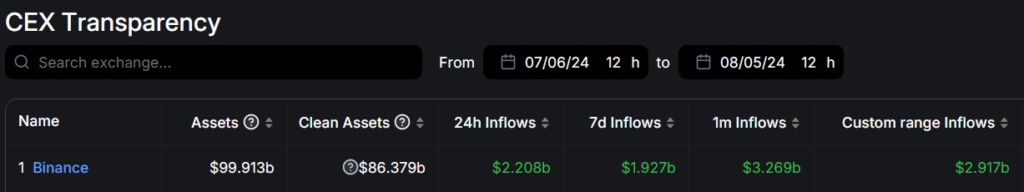

The inflow aligns with record trading volumes on Binance this year, further boosting the platform’s market position. Data from DefiLlama’s CEX Transparency metrics shows that Binance clean asset holdings now total $86.497 billion out of $100.11 billion.

This surge in capital coincides with today’s market rebound, causing the BNB price to sustain above the $400 floor.

Price of Binance Coin Reaches Key Support

The first week of August saw a significant fall in the price of Binance currency (BNB). This negative reversal caused the altcoin’s value to drop from $598 to $400 during the market correction, representing a 33% loss.

With today’s market spike, the price of BNB promptly recovered to $481, indicating that it may sustain itself above the broadening wedge pattern’s support trendline. The demand pressure at this dynamic support, which has stayed steady since March 2024, is highlighted by a long-tail rejection candle.

The potential rebound could push the asset 25% to challenge the $610 resistance.

Two divergence trendlines, on the other hand, make up the chart pattern and usually signify market players’ uncertainty. In the event that the reversal is unsuccessful, a 20% loss might be projected by the bearish collapse of the bottom support, which will extend the decline trend to $355.

Also Read :-Price forecast for BINANCE Coin for 2024–2030: Is BNB ready for the next big surge ?

Conclusion

Ultimately, BNB’s future price will depend on a combination of Binance’s business performance, the token’s utility, market forces, and the regulatory environment. But the recent $1.2 billion inflow and 12% price jump suggest investors remain bullish on BNB’s prospects.

Share this content:

2 comments